Despite how humorous it sounds, check kiting is no laughing matter. It’s a term often used by people who are into fraudulent activities in regard to checks and money. But there’s far more to it than that. So, I’ll demystify any illusions around the term for a type of fraud in this guide, where I break down the meaning and dig into the origin while sharing some sentence examples.

Check Kiting Meaning Breakdown

It’s a common, somewhat outdated term that you’d use to describe a fraudulent scheme where a person intentionally writes checks from one bank account to another, knowing very well there aren’t enough funds to cover the amount they wrote the check for.

The entire goal of check kiting is to take advantage of the “float” or the short period of time it takes for checks to clear. It allows the person to temporarily use non-existent funds.

But, since we rarely write out actual checks these days, the term has become less popular. I mean, why write a check when I can Venmo you in two seconds, right?

But it’s more than that. Here’s a simple example. You go to the grocery store, and your total comes to $50, but you have $0 in your bank account. You write a check from bank A for $50 to cover your purchase.

You then head to another store and buy something for $50, write a check for $100, and ask for $50 in cash. You then use that $50 in cash to cover the $50 that will come out of your account before the first check clears. You do this repeatedly to constantly cover the bad checks you’re writing because one will always be in flight.

People have been known to pull this off and use multiple banks, even going from bank A to bank B and so on, endlessly creating fraudulent checks.

Check Kiting or Cheque Kiting?

Ah, the eternal struggle between American and British English! (And Canadian, too!)

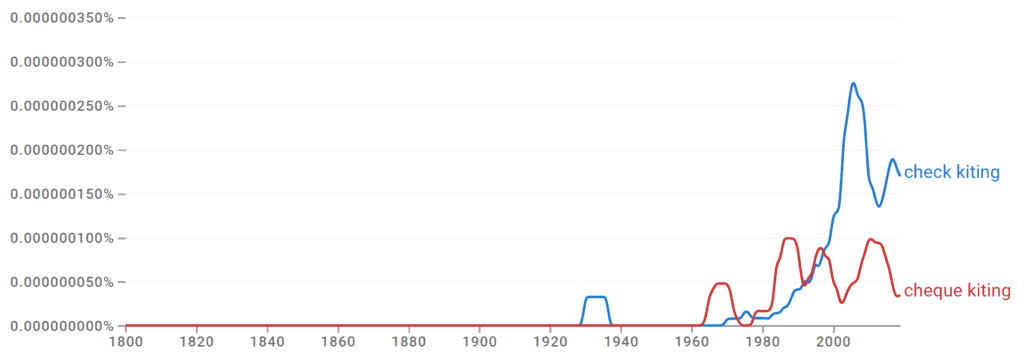

While our friends across the pond spell it “cheque,” as I do here in Canada, Americans always take the shorter route and spell it “check.”

As for the term “check kiting,” the same rule will apply. Use “check kiting” in the United States and “cheque kiting” in the United Kingdom, Canada, and other countries that follow British spelling conventions.

Check-Kiting or Check Kiting? When to Hyphenate

Much like most cases with hyphens, the decision to hyphenate “check kiting” depends on how you intend to use it.

You don’t have to use a hyphen when used as a noun.

- He was arrested for check kiting.

But you’ll have to use a hyphen if you’re using it as an adjective to describe the proceeding noun.

- She was found guilty of a check-kiting scheme.

Origin of Check Kiting

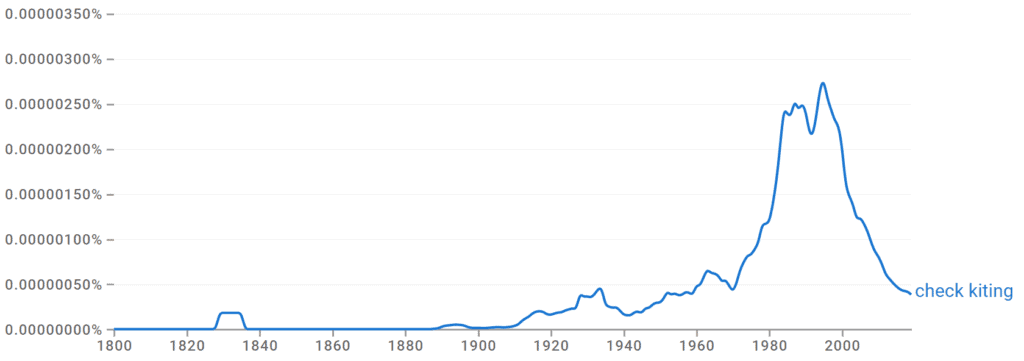

The term “check kiting” worked its way into society in the United States during the early 19th century when people were using written checks more than they are now.

It all stems from the idea that after you write or deposit a check, it’s “in flight,” like a kite flying through the air. While the banks wait for the funds to clear, a person can use that wait time to leverage their money to either get loans, withdraw large amounts, or write bad checks.

Other Ways to Say Check Kiting

Synonyms are great, aren’t they? Use any one of these terms in place of check kiting.

- Floating checks

- Playing the float

- Check floating

- Paper hanging

- Rubber check scheme

Check Kiting Examples in a Sentence

Within contexts like this, you should have no problem understanding how to use this term.

- Mike was caught red-handed in a check-kiting scheme that cost the bank thousands of dollars.

- The in-house accountant’s check kiting came to light during a routine audit of the company’s financial records.

- After years of successfully evading detection, Jane’s luck ran out when the bank tightened its check-clearing policies and uncovered her years of check kiting.

- The bank manager warned all his employees to be vigilant for signs of check kiting with their clients.

- Because of advanced banking technology and more convenient options, check kiting has become way more challenging to pull off and less common than it once was.

Bottom Line

So that’s a wrap on a lighthearted yet informative foray into the world of check kiting. Sure, the concept might have a fanciful name, but the practice itself is a serious financial crime with potentially severe consequences. So, don’t even think about it. But it’s good to understand the definitions of terms like this so you’ll know what it means the next time you hear it.

Related Articles: